I input this information into turbotax and it ask me if i d like to use a special depreciation allowance and deduct the entire expense this year.

Residential roof depreciation life.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

Exclusion from income of subsidies for energy conservation measures.

Calculating depreciation based on age is straightforward.

I own a condo that i rent out.

Special depreciation allowance or a section 179 deduction claimed on qualified property.

When compared to the alternative option of depreciating the cost over a 27 5 year life for residential rental real estate or a 39 year life for commercial real estate under the modified accelerated cost recovery system an incorrect conclusion may lead to a significant overpayment of tax liability.

For example if the new roof costs 15 000 divide that figure by 27 5.

When depreciating real estate you ll need to use the.

Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged.

Residential energy credits you were allowed before 1986 or after 2005 if you added the cost of the energy items to the basis of your home.

As with the restoration costs discussed above these costs are in the same class of property as the residential rental property to which the furnace is attached.

This means the roof depreciates 545 46 every year.

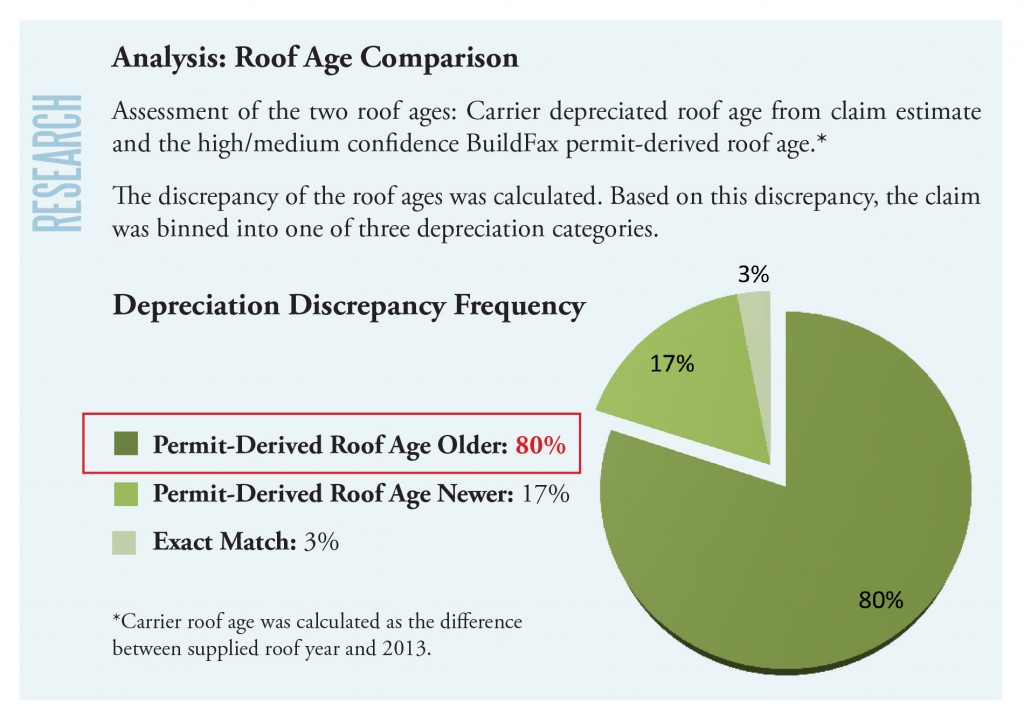

When a claims adjuster looks at a roof he will consider the condition of the roof as well as its age.

Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance.

At the end of last year the roof for the entire building was replaced.

The roof depreciates in value 5 for every year or 25 in this case.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

Improvements are depreciated using the straight line method which means that you must deduct the same amount every year over the useful life of the roof.

For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property.

Residential real estate has a depreciation period of 27 5 years and nonresidential real property is depreciated over a 39 year lifespan.